Cash Flow Statement

The last of the major financial statements is the cash flow statement, also known as the “statement of cash flows”.

So, what is it? And, why do we need it?

The statement of cash flow, or cash flow statement, details the enterprise’s cash flow – the inflows and outflows of cash.

How is this different from the Income Statement, you ask. Well, there are many revenues received by the company and many expenses incurred that do not involve the outlay of cash (at least at that particular time). As such, it is important to have a stand-alone statement that identifies specific scenarios when cash changes hand.

It tells managers and owners what is happening with cash in the business. It also reveals how cash is generated and from where and when it is expended during a specific period of time.

Understanding how to create the cash flow statement is an advanced topic covered in our accounting course.

For now, let’s learn about the sections of the statement.

What are the Sections of the Statement of Cash Flows?

Cash receipts and cash payments are summarized and categorized as operating, investing, or financing activities. Simply put, the statement of cash flows indicates where cash came from and where cash went for a period of time.

As such, there are three unique sections to the statement of cash flow. It’s broken down into:

- Operating activity

Operating activities include cash activities related to net income (revenue minus expenses paid). For example, cash generated from the sale of goods (revenue) and cash paid for merchandise (expense) are operating activities because revenues and expenses are included in net income.

- Investing Activities

Investing activities include cash activities related to non-current assets. Non-current assets include: (1) long-term investments; (2) property, plant, and equipment; and (3) the principal amount of loans made to other entities. For example, cash generated from the sale of land and cash paid for an investment in another company are included in this category. (Note that interest received from loans is included in operating activities.)

- Financing Activities

Financing activities include cash activities related to non-current liabilities and owners’ equity. Non-current liabilities and owners’ equity items include (1) the principal amount of long-term debt, (2) stock sales and repurchases, and (3) dividend payments. (Note that interest paid on long-term debt is included in operating activities.)

Using these accounts, the statement of cash flows provides cash receipt and cash payment information and reconciles the change in cash for a period of time.

Rather than showing every single transaction in a formal report, the statement of cash flows summarizes these transactions.

For example, all cash receipts from paychecks are added together and shown as one line item, all cash payments for rent are added together and shown as one line item, all cash payments for food are added together and shown as one line item, and so on.

The goal is to start with the beginning of the year cash balance, add all cash receipts for the year, subtract all cash payments for the year, and find the resulting end-of-year cash balance.

Example of a Simple Cash Flow Statement

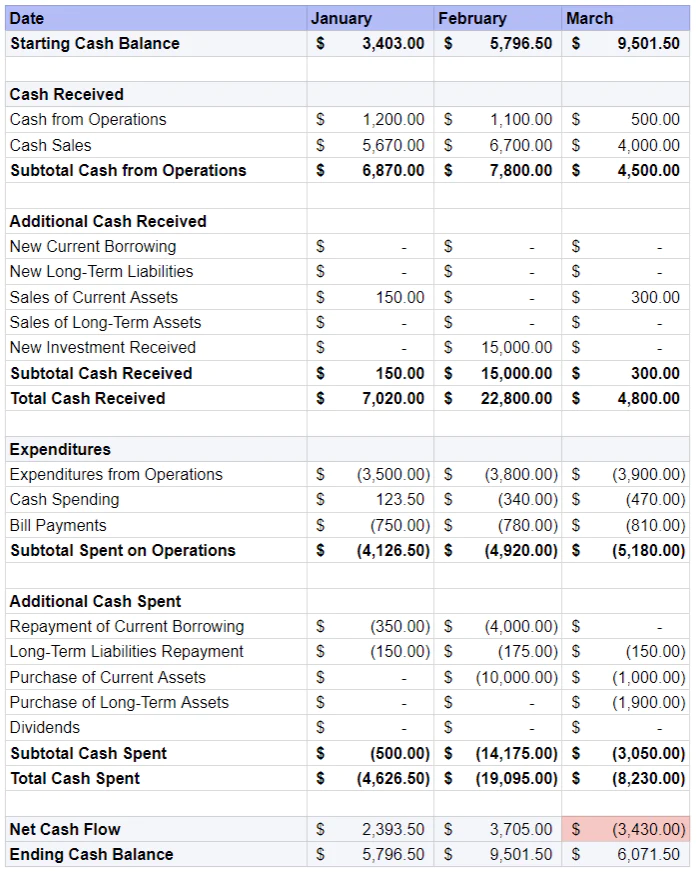

The below cash flow statement demonstrates the change in cash balance for three consecutive months.

Notice how categories of cash inflows are first added to the existing cash balance. Then cash outflows are subtracted from the balance. The result leads to the starting cash balance of the next month.