Balance Sheet

Now, let’s talk about the most well-known of the financial statements – the balance sheet.

A balance sheet is a report or statement containing all the assets, liabilities and shareholders’ equity owned by a business at a specific time. More specifically, it is the financial statement that contains the details of a company’s asset, equity and liabilities over a period of time time.

In summary, it tells you what a company has or is entitled to and what is owes or is obligated to do. It does this by categorizing various types of assets (valuable things held), liabilities (value owed to others), and Shareholder’s equity (a combination of value contributed to the company by shareholders and any retained earnings).

The combination of these broad categories is known as the “accounting equation”, discussed below.

The balance sheet gets its name from the fact that the accounting equation must always be in balance.

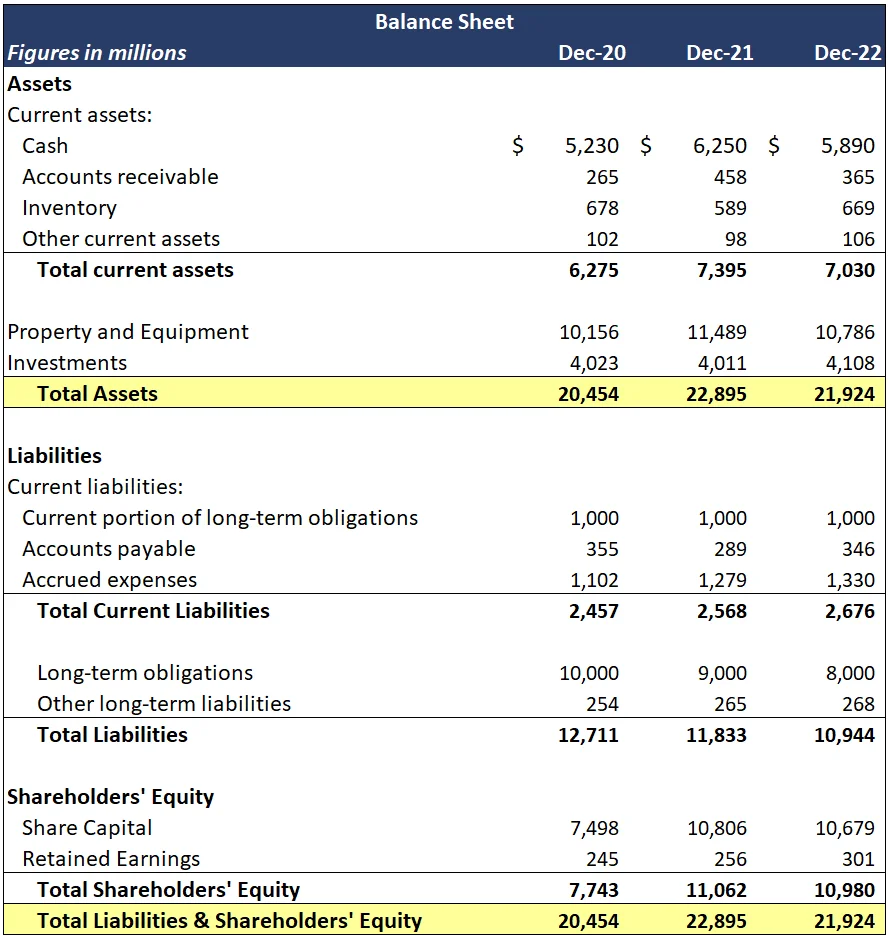

Example of a Simple Balance Sheet

Take a look at this simple balance sheet. Notice that categories of assets, liabilities, and shareholder’s equity. In this balance sheet, the balances of each account at the end of years 2021, 2022, and 2023 are shown.

What is the Accounting Equation?

The accounting equation is as follows:

Assets = Liabilities + Shareholders Equity

As previously stated, this formula stands for the proposition that accounts always balance on the balance sheet. Any transaction that affects one side of the equation, equally affects the other.

More specifically, any recorded increase in assets must also entail the recording of a rise in either a liability (the debt owed for the asset) or shareholder’s equity (the value of retained company value).

In our accounting course, we go into the process of recording transactions that result in a change in assets, liabilities, or shareholder’s equity. For now, just understand this fundamental principal that the accounting equation must always balance.

Let’s dig deeper into what makes up company assets.

What are Assets?

Assets are things of value held by the company.

There are two broad categories of assets, these are “current assets” and “non-current assets”.

Current assets can be converted into cash in a year or less than year.

Non-current assets cannot be converted into cash within a short period of time, they are long-term assets.

Examples of Current Assets

- Cash and cash equivalents (hard currency, treasury bills and others.)

- Inventory (goods available for sale)

- Prepaid expenses such as rent and insurance.

- Marketable securities.

- Accounts receivable (cash that customers owe the company.)

Examples of Non-current Assets (Long-term Assets)

- Fixed assets such as machinery, land and buildings.

- Intangible assets (trademark, goodwill and intellectual property).

- Long-term investments.

Now, let’s take a look at liabilities.

What are Liabilities?

Liabilities in a company’s balance sheet comprises the value the company owes to others.

More specifically, it is the money it owes or value of services due to be rendered to outsiders. Money owed or to be paid might include, payments to vendors and suppliers, salaries, rent, utilities and money it owes creditors. The value of services to be rendered include the obligation to deliver goods or perform services for which a customer or client has already paid.

There are two categories of liabilities, these are;

- Current liabilities, and

- Long-term liabilities.

While current liabilities are those due within a year, long-term liabilities have longer life span. Below are examples of accounts under each category of liability.

Examples of Current Liabilities

- Dividends payable

- Bank debts

- Rent, tax, wages and utilities payable

- Interests payable

- Current portion of long-term liability, and

- Customers prepayments.

Examples of Long-Term Liabilities

- Long-term debt

- Deferred tax liability

- Pension fund liability.

It is important to know that there are some liabilities that are not recorded on the balance sheet, they are called ‘off the balance sheet liability.’ We discuss these in the accounting course.

Let’s now take a look at the last part of the equation.

Shareholders’ Equity

Shareholders’ equity refers to the amount of money or value held by the company that belongs to the owners of the company.

Shareholders of a company are investors who hold an ownership interest in the company. The shareholder’s equity is categorized based upon the nature of the ownership interest held by shareholders or how the value was acquired by the company.

The forms of shareholders’ equity are:

- Shares of Stock

Shareholders receive an ownership interest in a company in exchange for value provided to the company. The ownership interest is represented by shares of stock.

Common shares are the basic ownership interest of the company. Preferred shares of stock are special shares that can be converted to common shares are a later date.

Treasury stock are shares of stock that have been repurchased from shareholders by the company. They are held in the treasury in case they need to be used for specific transactions, such as posting a collateral for company loans.

- Contributed capital or additional paid-in capital

Contributed capital is the value of funds invested into the company by founders or investors in exchange for the receipt of common or preferred shares of stock.

- Retained earnings

These are the earnings of the company set aside to pay dividends to shareholders, settle debts, and for reinvestment purposes. The retained earnings are derived from company profit (revenue that exceeded expenses).

As you can see, this portion of the balance sheet incorporates the information contained in the statement of retained earnings.

Why the Equation Balances

Balancing the accounting equation is at the heart of the accounting system. It is a self-accountability function.

Any addition or subtraction from assets is always accompanied by an increase or decrease in liabilities or an increase or decrease in shareholder’s equity.

Limitations of Balance Sheets

Despite that the balance sheet is of importance to analysts and those who want to invest in a company, it has some limitations. Below are some of the limitations of a balance sheet;

- A balance sheet is not a dynamic financial statement, it is static.

- The figures contained in a balance sheet can easily be influenced by factors such as inventories, depreciation or amortization.

- Financial managers can manipulate a company’s balance sheet to make out attractive to investors.

- There are multiple accounting systems used for balance sheet.

- A balance sheet only contains the financial condition or position of a company for a specific time, and not historical periods.