Statement of Retained Earnings

The statement of retained earnings is a standalone document that reports the retained earnings of the company.

It would probably be helpful if we began by explaining, what are retained earnings.

What are Retained Earnings?

Retained earnings, also known as “accumulated earnings” or “accumulated earnings and profits”, can be defined as a company’s accumulated surplus or profits after paying out the dividends to shareholders.

Restated, if a company makes a profit from operations (more revenue than expenses), then the company can either distribute those profits to the business owners or retain those profits to use in future operations.

So, you can think of retained earnings as the company’s extra earnings available at management’s disposal. In most cases, the management uses this reserve money to sustain operations and grow the business.

How Do You Calculate the Retained Earnings?

The Retained Earnings Formula is as follows:

RE = (Beginning Period Retained Earnings + (Net Income/Loss) – Cash Dividends – Stock Dividends)

This formula looks more complicated than it. Basically, take your profits and add it to any previous profits (or subtract losses) from any profits that the company kept or retained in the business. The subtract the money flowing out of the retained profits in the form of cash or the cash value of stocks flowing out as compensation. This gives you a company’s retained earnings.

Now, let’s see how these are presented in a financial statement.

What is the Statement of Retained Earnings?

The statement of retained earnings is also known as the “statement of owners equity”, “statement of shareholders equity”, or an “equity statement”.

So, what is it?

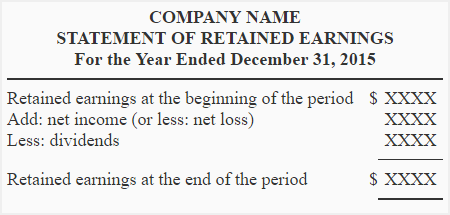

The statement of retained earnings refers to the financial statement of an organization that highlights the changes to the retained earnings during a given time period.

Thus, this document does the reconciliation of retained earnings for the starting and ending period.

It uses crucial insights like net income recorded in other financial statements for doing the reconciliation of data. So, you have to understand whether you have profits or losses that either add or subtract from the existing retained earnings.

The statement of retained earnings follows GAAP, commonly known as generally accepted accounting principles.

The statement of retained earnings helps in increasing investor confidence in the company and improving market. It helps in assessing the financial health of an organization.

In reality, the document is extremely simple, and does little more than demonstrate the “retained earnings formula” (from above) over an identified time period.

Example of a Simple Statement of Retained Earnings