Budgeting

The final major aspect of finance is the ability to allocate and track resources to projects. This process is captured in a budget.

What is Budgeting?

A budget is a plan of the resources needed to achieve the organization’s goals.

It generally involves estimating the resources necessary to carry out operations for a specified period for time or the total resources required by a project.

The resources necessary are valued and designated as expenses. The expenses may be listed individually on small projects or categorized together for bigger projects or operations.

- Note, the budgeting process requires the use of terms previously discussed in the accounting section. Mainly, it results in the creation of a simply income statement and balance sheet for the budgeted activity.

The budget may also contains projections of income or revenue acquired for or from the operations or project. This is applicable when the operations or project will yield income that is available to be re-employed by the operating unit.

In larger companies, operations or projects are funded by the company. Because the company will provide all of the resources necessary to carry out the project (and revenue generated is not available to the operating unit), then a budget will consist of a fund allocation amount and the timing of fund allocations to be received.

Simple Example of a Budget

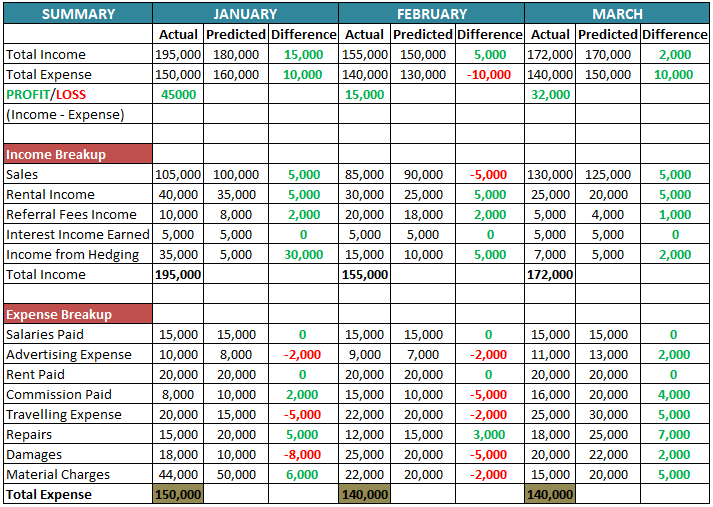

Below is an example of a simple budget.

You will notice that this budget tracks actual and expected revenue and expenses. It breaks down expenses into individual line items. This is common in simple budgets that track the revenues and expenses of the entire business.

The budgeting process in large organizations that have various operating units can be very complicated. Generally, each operating unit develops a budget. These budgets are then combined together into a master budget.

Further below in this material, we identify numerous budgets used for operating units and explain how each are used to arrive at a master budget.

The Budgeting Process

As mentioned, organizations create a budget to project the revenue and expenses of the operating period (income statement) and a statement of capital expenditures and acquisitions (balance sheet).

The process of creating these documents begins with creating several sub-budgets that are later combined into a master budget.

Below we introduce the various budgets created in large organizations as part of the budgeting process. At this point, just focus on learning the types of budgets and their role in creating the master budget.

We provide the example of a company that manufactures and sales goods. The service industry budget is generally more simple – as it does not require the purchase of materials for manufacturing.

In any event, you can apply this approach equally to service-based businesses by undertaking the relevant or applicable types of budget.