Measuring Project or Investment Value

We now understand the sources of funding and how companies make decisions regarding their capital structure. The question becomes how do companies choose which projects or operational activities to pursue.

Fortunately, finance allows us the ability to make decisions with regard to how we use our resources. Most notably, it allows us to calculate the value of a project based upon:

- the amount of investment necessary to pursue the project,

- the projected amount and timing of cash flows generated by the project in the future, and

- the risk rate or discount rate applicable to the project.

There are many business and project valuation techniques used to determine the expected value of a particular investment of resources. This is the part of finance that depends heavily upon calculations.

It is important to note that each technique is suited to a particular type of investment.

Below, we introduce five concepts to demonstrate two popular models for evaluating an investment opportunity:

- Payback period

- Rate of Return

- Accounting Rate of Return

- Net Present Value

- Internal Rate of Return

Don’t worry if these concepts don’t make complete sense just yet. This material will give you a strong base to further understand these topics in our Finance Course.

What is Recurring Revenue?

The value of any project (or business for that matter) is the value of revenue from the project or activity or the potential for revenue in the future based upon growth in users or value delivery.

Revenue is any form of money coming into the business. The most valuable form of revenue is called, “recurring revenue”.

Recurring revenue refers to the specific percentage of an organizations revenue that persists in the coming years. For example, you land a client subscriber. The client will continue to pay the subscription amount into the future. This is recurring revenue.

Contrary to one-off sales, recurring revenues can be easily predicted, are consistent, and can be predicted to take place at specific time periods.

Recurring revenue is very significant, as it is a primary metric in valuing many businesses or determining the potential value of projects. It also provides some level of certainty of future company performance and the ability to meet debts or obligations as they arise.

Now that you understand the importance revenue in valuing a project, operational activity, or business, let’s take a look at some of the means of valuation.

What is a Payback Period?

The payback period is the time it takes to recover the money invested in a project or investment.

One method for determining profitability is to keep in view the payback period. To calculate the payback period, divide the amount of money invested by the expected annual return.

- Note: Unless you add some discounting approach (discussed below), the payback period does not take into account the time value of money or the expected rate of return on the initial investment. To incorporate these metrics, it is better to employ other methods, such as DCF (Discounted Cash Flow), NPV (Net Present Value) and IRR (Internal Rate of Return). This concepts are mentioned below; but, they are discussed in greater detail in our Finance Course.

Payback Period Example

Suppose, a company invests one million US dollars in a project which, most probably, can save 250,000 USD for the company every year. The payback period will be four years. To calculate this, we divide one million USD by 250,000 USD.

Now, suppose there is another project costing 200,000 USD. There are no cash savings linked to it. But the company earns an return of 100,000 USD every year for the coming twenty years, i.e. two million US dollars. We divide 200,000 USD by 100,000 USD to arrive at a two year payback period.

As you can see, the payback period is simply how long it takes to get the money invested back. It does not really indicate the value of the project.

What is a Rate of Return?

Rate of Return (RoR) refers to the net profit or loss of an investment over a period expressed as a proportion of the original cost of an investment.

Restated, you take what every profit you make from a venture, project, or operational activity. Divide that total profit by the initial investment. It will provide you will the multiple of how much money your investment in the activity produced.

The formula for ARR is:

ARR = Average Annual Profit / Average Investment

Remember, profits are the income above expenses (or, the income realized from the sale of an investment plus the capital gains). A loss is when you do not make a return from an investment that exceeds the amount of investment.

Rate of return is usually expressed as a percentage.

For example, I invest $100 in a business venture or project. The project returns $400 over its life. The profit is thus $300. To calculate ARR, divide the $300 profit by the $100 investment. The return is 3x or 300%.

The rate of return can be calculated on any investment or asset like vehicle, real estate, shares, stocks among others as long as the asset was bought at one point and sold in future.

Accounting Rate of Return

The accounting rate of return is a variation of the rate of return. It represents the average net income which an asset is expected to generate divided by the average capital loss of that asset (expressed as an annual percentage or APR).

Contrary to the regular rate of return (which focuses on just cash investment) this approach takes into consideration an investment of physical goods.

The formula for ARR is:

ARR = Average Annual Profit / Average Investment

Where:

- Average Annual Profit = Total profit over Investment Period / Number of Years

- Average Investment = (Book Value at Year 1 + Book Value at End of Useful Life) / 2

The book value is the value of the goods (for accounting purposes) at the time of investment and at the end of the investment period – given that goods are depreciated a bit each year.

This formula is used to make budgeting decisions and to evaluate the profitability of investments.

We simply introduce the formula here. We will review its application in greater detail in our finance course material .

Note: Unless you add some discounting approach, the primary issue with the ARR that it does not take into account the time value of money or inflation.

The turnover achieved in the near future is recognized as a turnover in the distant future.

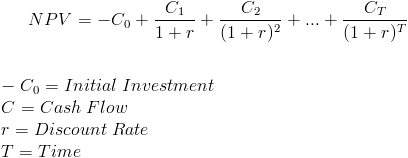

What is Net Present Value?

Net present value (NPV) refers to the variance between cash flows over a period of time.

It measures the difference between the present value of cash inflows and cash flows for a given time.

NPV accounts for the value of time, value of money, and cash flows (inflows and outflows) in a given period of time.

NPV is used for analyzing how profitable an investment or project will be, investors or portfolio managers often use it in capital budgeting and investment planning.

NPV is calculated as the present value of expected cash flows minus the present value of invested cash.

restated,

NPV = (Todays value of the expected cash flows) – (Todays value of invested cash).

When NPV is positive, it is an indication that the returns or discount rate generated by a project is higher that its planned costs.

The formula for the NPV is as follows:

This may look scary; but, don’t worry. This just says that when you have multiple cash flows happing in the future, you need to discount those cash flows each year to see what is the present value.

You discount them with a discount rate that represents a combination of inflation rates and the rate of interest or return that the investment would receive in the average investment of this type in the marketplace.

Because these cash flows happen in successive years, you have to discount a cash flow that is two years out – two times; and a cash flow that is three years out – three times; etc.

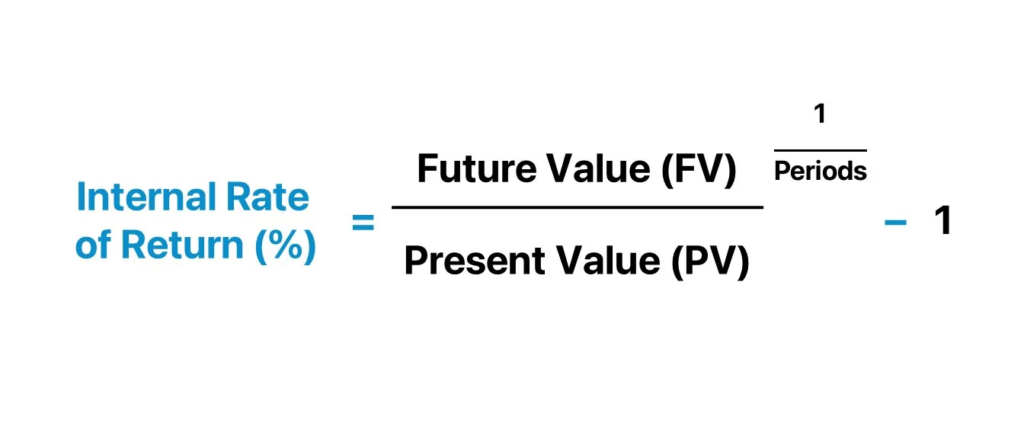

What is an Internal Rate of Return?

Internal rate of return (IRR) refers to a metric utilized in capital budgeting to estimate how profitable potential investments are.

In reality, the IRR is simply a backwards method of calculating the NPV. But, you are calculating the discount rate that will make the NPV of the project “0”.

Restated, the IRR is used calculate the net present value (NPV) of all future cash flows generated from a specific project or investment that makes the project break even.

Recall, in the NPV calculation, you were identifying an applicable discount rate (generally an industry rate) and seeing what was the NPV of the future cash flows. With IRR, you assume the NPV is “0” and are looking for the discount rate that would make it that amount.

This is a great tool for comparing two projects. It shows you the rate of return or discount rate applicable that makes the project or activity break even. If the discount rate is higher than the industry rate for this type of project, then you know that undertaking the project is an acceptable course of action.

Here is the formula:

Don’t worry if this doesn’t fully make sense. We will review it in detail in the financial course material.

I can say with full confidence. If you understand these methods of determining project value, you have a stronger understanding of finance than most business professionals you will encounter.