Industry Analysis

Industry analysis aids in understanding the environment in which the company must operate. It helps in developing a strategy at each level of the organization.

What is the Industry Life Cycle Analysis?

Industry life cycle analysis is a tool for assessing industries and companies based on the stages of development at a particular period.

Four stages have been identified in the lifecycle of a business or industry, they are; expansion, peak, contraction, trough.

Other terms used in describing these stages are introduction, growth and maturity.

Businesses and analysts use the industry life cycle analysis to evaluate the developmental stage a business is in and also make future projections of the performance of the business or industry.

Stages of the Industry Life Cycle Analysis

There are four stages in an industry life cycle, these are;

Expansion

During this stage, a company or an industry experiences growth, increased sales and profits margins and develop the capacity to produce more goods needed to meet the demand of the customers.

Peak

At this stage, the growth has reached the last stage as well the demand have been met, it then drops to level zero. The profit previously accumulated also flattens out as growth drops to zero.

Contraction

This is a period when an industry experiences lower sales and profits, the company also records less activities. The contraction stage is often accompanied by a recession in the economy.

Trough

This is the period when the industry begins to gather momentum and heads towards recovery. Once the industry regains strength, it begins its life cycle again with expansion.

Understanding Your Business Position in the Industry

The previous discussion analyzes the business and the overarching environment affecting the business. Now we turn our sights to understanding our business place in the industry. The most common and well-known tool for examining the business situation is Porters Five Forces (PFF), again introduced by Harvard Business Professor Michael Porter. The overall purpose of the PFF analysis is to allow you to use your knowledge to strengthen your position in the market. Particularly, it is useful in determining whether a new strategy, product, or business model will be successful in the relevant market.

What is Porters Five Forces?

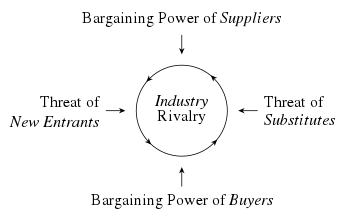

Porter’s five forces breaks down a given business position into five distinct forces. The forces are as follows:

- Supplier Power

- Buyer Power

- Competitive Rivalry

- Threat of Substitution

- Threat of New Entry

Breaking Down the Forces

The PFF analysis demonstrates the market power of the business with regard to this business force. The following diagram displays the interrelation of the forces.

Here is a brief overview of each force.

Supplier Power

Supplier power addresses the relative strength of suppliers in the industry. A supplier with more power has a greater ability to bargain for and capture value in the exchange of value between them and the customer (your business).

Buyer Power

Buyer power, similarly supplier power, concerns the power dynamic between the company and (in this instance) purchasers of the product or service. Buyer power may be high based upon the number of buyers, the importance of individuals buyers, and the ease or low cost in switching to other suppliers.

Competitive Rivalry

Competitive rivalry concerns the ability of your competitors to increase their market share. If you have numerous competitors or any competitors with superior value propositions (lower price, higher quality product, etc.) then your competitors have strong market power.

Threat of Substitutes

Are there closely-related products in the market that can substitute for the value proposition provided by the company’s product or service. These products and companies are generally not thought of as direct competitors. Instead, they become an option when the primary product is less desirable because of price or availability. As an example, a substitute for a vacuum cleaner may be a broom. They deliver a very similar value via different means.

Threat of New Entry

The threat of new entry concerns the ability of new competitors to enter the market. New competitors often increase competition and ultimately push down prices. Further, new competitors will occupy some portion of the market, which may diminish your business existing market share.